The market headlines will be taken up by the blow up between President Trump and the visiting Ukraine Prime Minister Zelensky. The two leaders had a heated debate in front of the media at the White House on Friday which led to Zelensky leaving the White House early. How this will shape the markets this week will be hard to tell as this isn’t the only market moving event lined up. President Trump also plans to go ahead with tariffs against China, Canada and Mexico this week, whilst talking of applying 25% tariffs to Europe.

Forecast for March 3, 2025

USD Outlook

The Trump trade tariff risk looks to be back with the USD finishing last week bullish. This combined with the added risk of the fallout between President Trump and Prime Minister Zelensky on Friday could add further risk to the market. We can already see the impact trade tariffs risks had, with the US stock markets closing bearish for a second consecutive week. If the market feels that Trump's tariffs could go ahead then we may see further USD strength especially against the EURO, CAD, NZD and AUD.

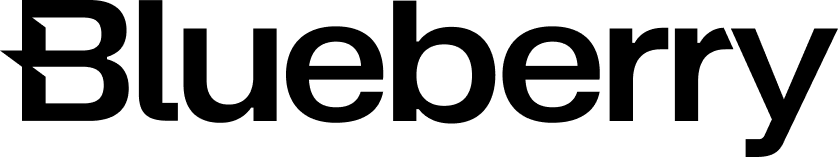

EURUSD in particular continues to trade below the key 1.0500 resistance. If the USD remains strong on the trade tariff issue then EURUSD could trade lower back towards the lows of 1.0200. Extra risk will be on the table for the forex pair this week as the ECB (European Central Bank) meets this week with the expectation of a 25 basis point rate cut.

AUD Outlook

The Australian dollar has been impacted by the resurgence of tariffs on China. Despite the RBA likely to hold interest rates in their next meeting the Australian dollar continues to weaken. Retail sales this week is forecast to rise from -0.1% to 0.3% highlighting demand within the economy. The RBA wants to see inflation fall further towards 2% before being able to cut interest rates again.

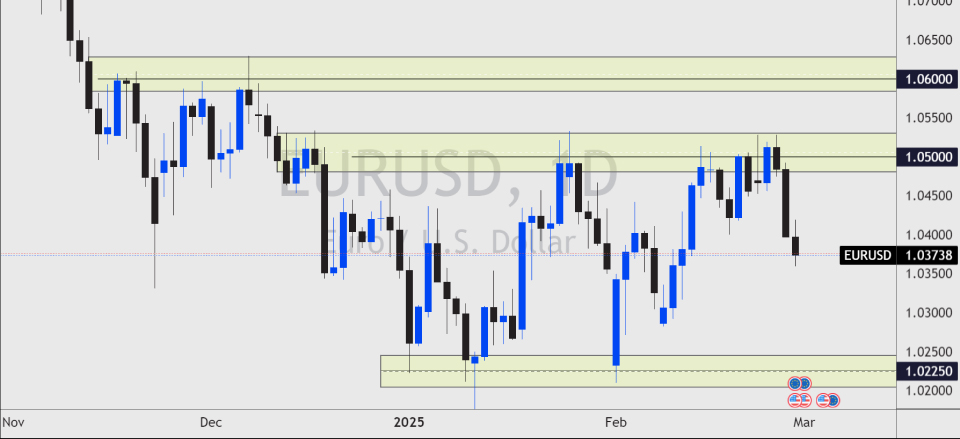

GBPAUD continues to trade higher and is approaching the 2020 highs of 2.0500. The price could find support on a pullback to the previous highs of 2.0000.

GOLD Outlook

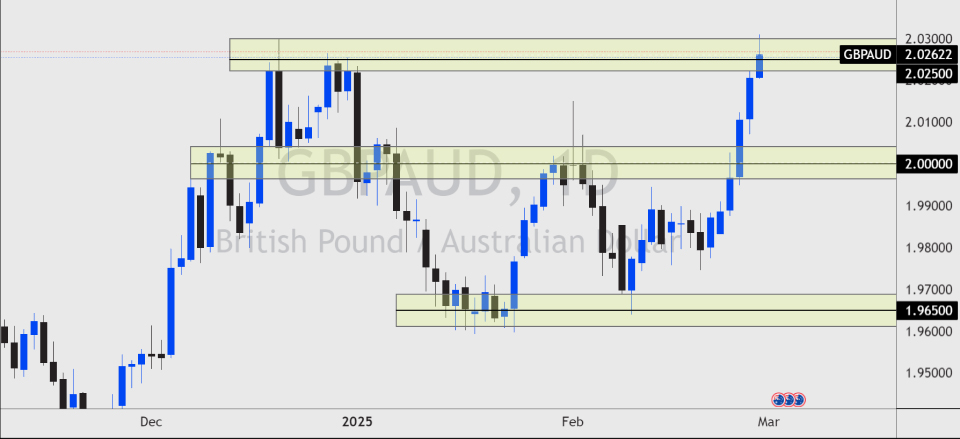

The price of Gold fell over 2.5% last week in correlation with the US stock market. This was the first bearish weekly close in over 8 weeks. We could see the price of Gold head back down to the previous weekly supporting highs of $2,750.00.

A lot of analysis suggests Gold prices could reach $3000.00 before the end of the year. However the price could retrace further before continuing the upward trend.

NASDAQ Outlook

The US stock market fell for a second consecutive week as trade tariffs came to the forefront yet again. Extra added risk in the market could see the risk off sentiment remain which can negatively impact the stock market. The price of NASDAQ retested the January lows of 20,750. If this level holds then we could see a short term rebound to the market. However a break below this level could see the price fall much further.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.