Get ready for a dynamic week in the forex market! 📈 Global bank holidays are wrapping up, bringing back normal trading volumes. From revised US PCE Price Index to key data releases and speeches, it's all eyes on the charts. 🌐 Keep an eye on European CPI and Swiss inflation data too. Stay tuned for market movements! 💼💱 #Forex #MarketAnalysis #Trading

Watch the video to learn more...

As global bank holidays conclude on Tuesday, market volumes are anticipated to return to their usual levels. Last Friday saw a notable revision in the US CORE PCE Price Index m/m, which was adjusted upward from 0.4% to 0.5% for January, followed by a March figure of 0.3%, aligning with expectations. Fed Chair Powell's subsequent speech underscored that the data fell within expectations and reassured that inflation risks remain subdued.

This week, the focus remains on US data, with the latest jobs report, ISM Manufacturing/Services PMIs, and another speech from Fed Reserve Chair Powell on the docket.

In Europe, all eyes are on the German Preliminary CPI, which is anticipated to hold steady at 0.4%. Any deviation from this forecast could trigger a decline in the Euro, particularly in light of the consecutive declines in German Manufacturing. Analysts are keen for further insights from ECB President Lagarde regarding potential interest rate adjustments to bolster German data, although President Lagarde has displayed caution in implementing rate cuts prematurely.

Meanwhile, in Switzerland, attention turns to the Consumer Price Index m/m, expected to dip from 0.6% to 0.3%. This release follows the recent interest rate cut by the SNB in response to persistent inflationary pressures.

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- USD Index remains below the key highs of 104.90, this level could be targets for buyers this week, if the data from the US continues to come in better than expected.

- A break above this level could invite further buying momentum with 106.00 being the next resistance highs. Support below rests at 104.28.

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- EURUSD price moved lower last week and is trading around the support of 1.0800.

- A break below this zone could see price re-visit the recent support level of 1.07000.

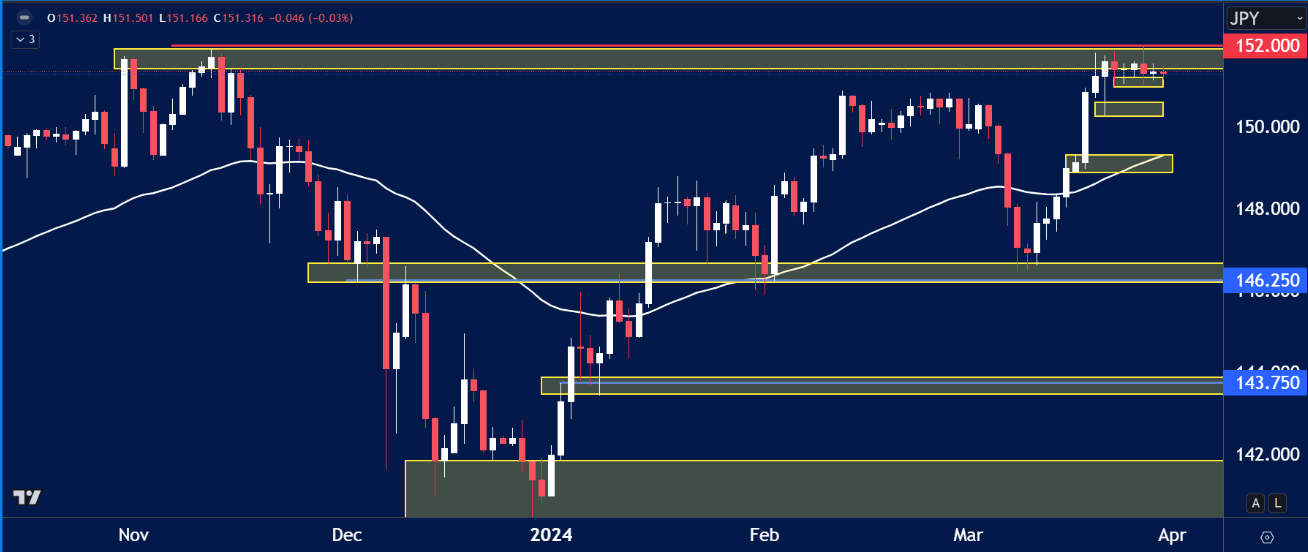

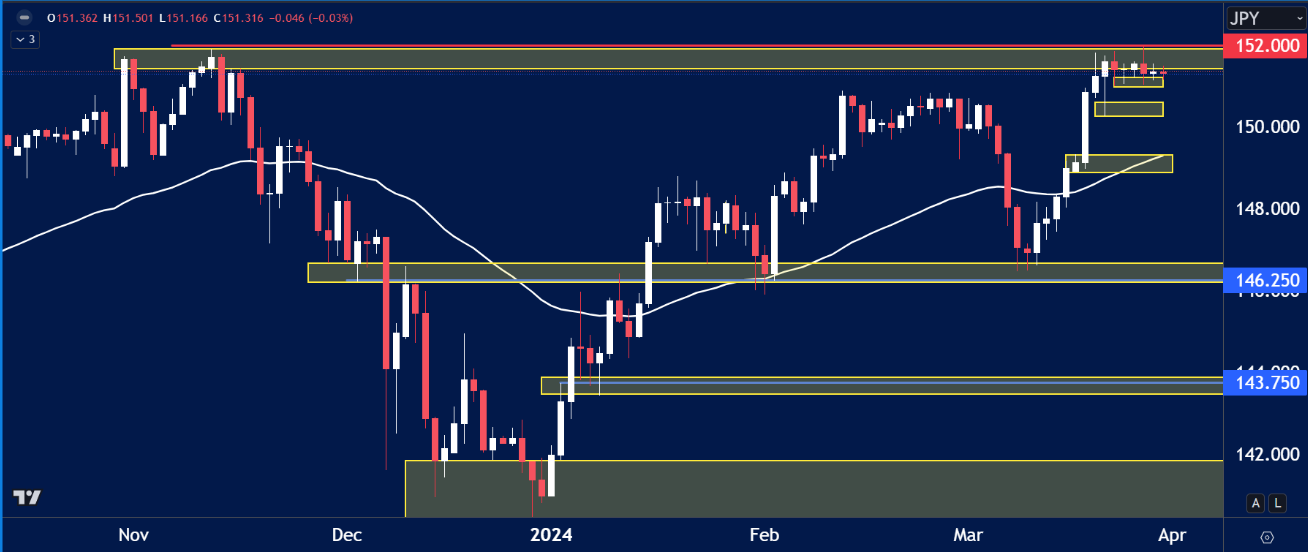

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- USDJPY remained in a tight trading range last week, despite the potential intervention by Japan officials.

- Highs of 152.00 seem to be defended by traders currently, but if this price breaks we could see a sharp move towards 160.00, which could provoke intervention.

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- Gold rallied again last week as expected. CoT reports highlight that commercials are not yet at extreme levels of selling, so a top in Gold is unlikely to form just yet.

- Price could find support at previous highs at the $2208.00 levels.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.