Exploring the dynamics of AUDJPY! Join us as we dissect the latest trends and analysis on this currency pair. Get ready to gain valuable insights!

Watch the video to learn more…

As the Reserve Bank of Australia (RBA) prepares to release its meeting minutes, all eyes are on the AUDJPY currency pair. In the previous meeting, the RBA maintained its hawkish stance by holding interest rates steady at 4.35%. This decision sparked curiosity among market participants, prompting speculation about the rationale behind maintaining the status quo.

The forthcoming meeting minutes are anticipated to provide valuable insights into the factors influencing the RBA’s decision-making process. Analysts and traders alike are eager to gain a deeper understanding of the economic conditions and indicators that prompted the central bank to keep rates unchanged. Clues embedded within the minutes could potentially unveil the RBA’s outlook on future monetary policy adjustments, thus influencing AUDJPY’s trajectory in the forex market.

Meanwhile, the Japanese yen (JPY) has been exhibiting weakness despite speculation surrounding the Bank of Japan (BoJ) potentially raising interest rates. Many analysts have predicted that the BoJ might hold rates steady against other central banks that are contemplating rate cuts. However, the lack of concrete evidence supporting such a hike has contributed to the yen’s vulnerability in recent trading sessions.

The AUDJPY pair stands at a pivotal juncture, with market participants closely monitoring both the RBA’s meeting minutes and developments within the Japanese economy. The interplay between the monetary policies of both countries and their respective economic indicators will likely shape the pair’s movements in the coming days.

AUDJPY

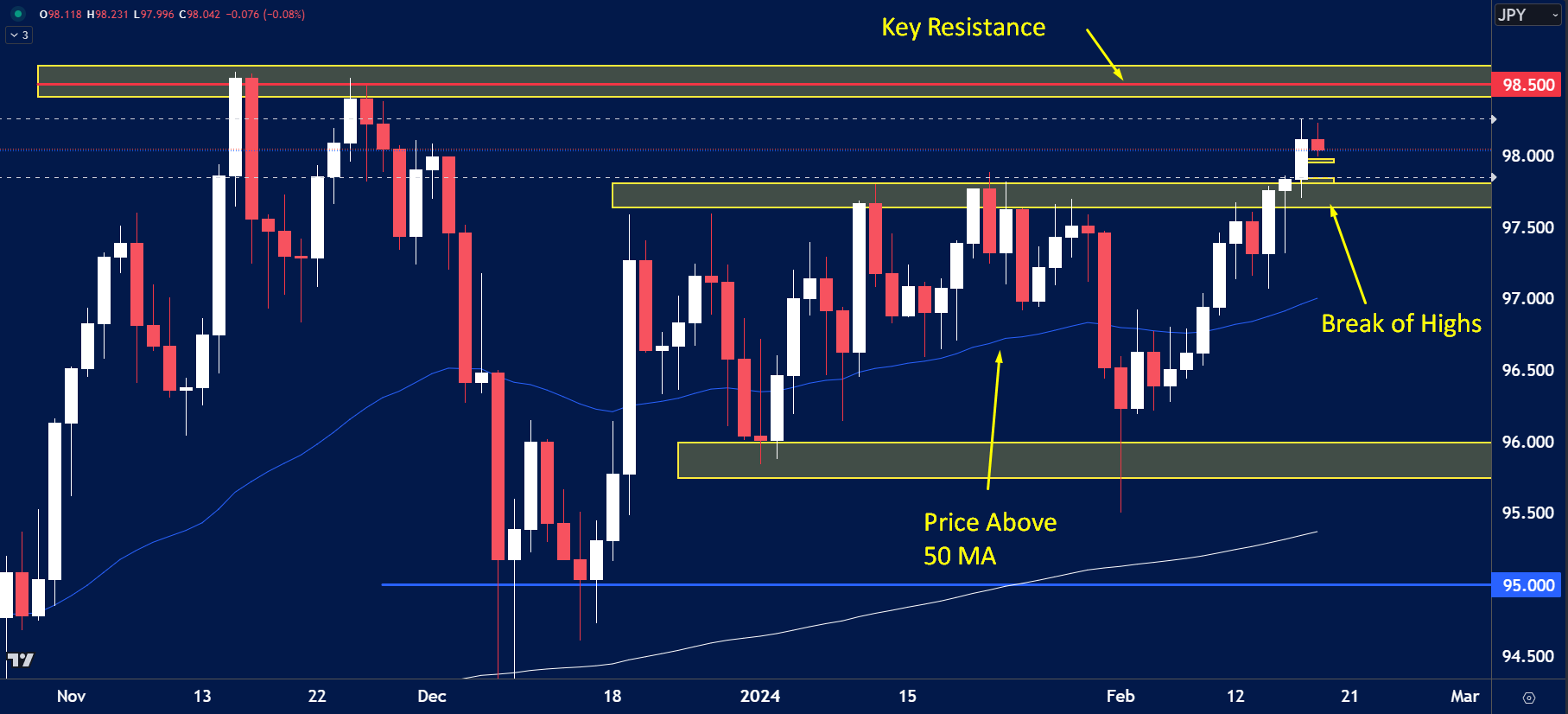

The price on the chart has traded through multiple technical levels and some observations included:

- AUD/JPY closed bullish the week of 12th-17th Feb, above key highs of 97.80 formed on 22nd Jan.

- Price could now seek the highs formed in November 2023 around 98.50.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.