US CPI data remains steady at 3.4%, falling short of expectations. 📉 Volatility stays low, but a rate cut in September looks more likely with 71% probability. Will inflation trends shift the Fed's stance? #MarketUpdate #CPI #Inflation #FedRateCuts

Recap the live stream to learn more...

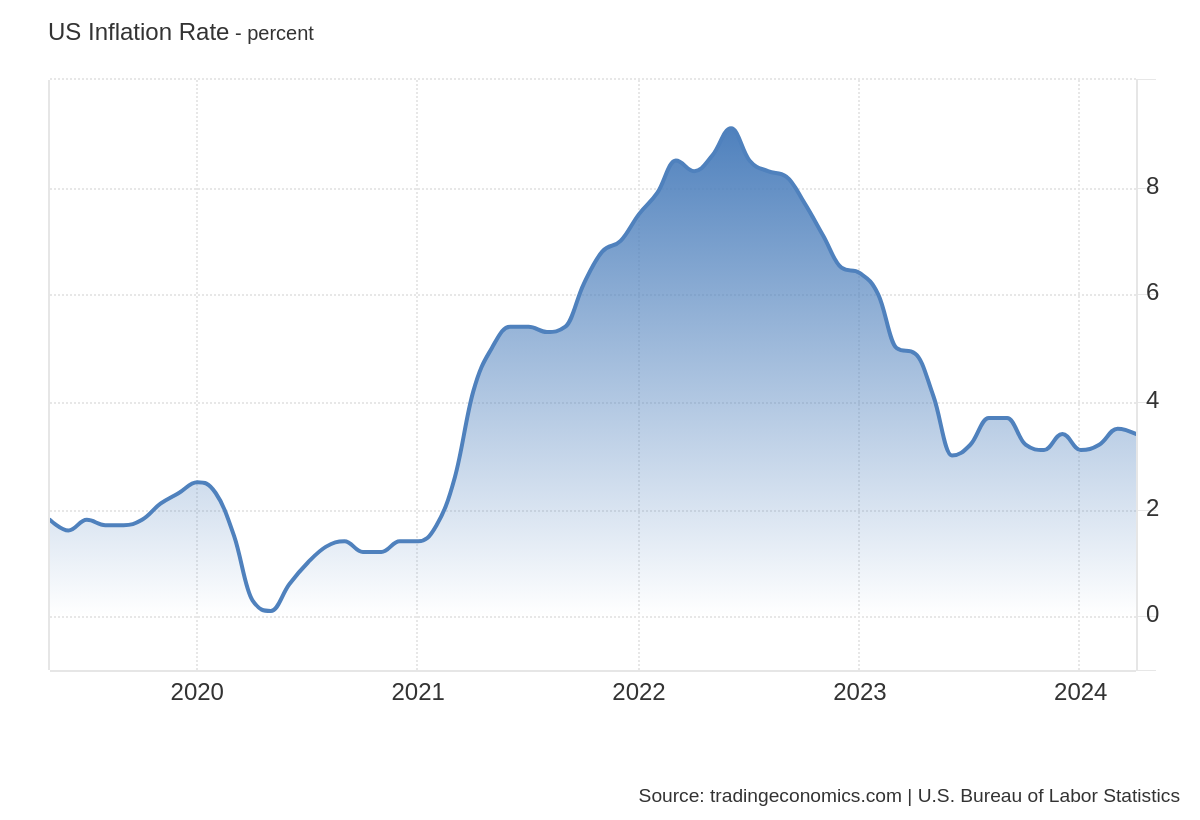

The latest US Consumer Price Index (CPI) data didn't deliver the surprise many traders and analysts, including myself, were hoping for. With volatility nearing significant lows, an unexpected shift in CPI was anticipated to shake things up.

A move towards a 3% inflation rate would have bolstered the market's narrative for interest rate cuts, potentially bringing a July cut back into consideration. Conversely, a higher-than-expected rate near 4% would have shelved cut discussions and possibly strengthened the USD.

Instead, the inflation rate remained steady at 3.4%. This "sticky" inflation suggests the Federal Reserve might maintain higher rates for longer, given their data-focused approach.

Meanwhile, US 10-Year Bond Yields continue to decline, indicating a potential drop in USD strength due to their high correlation. The CME FedWatch tool now shows a 71% probability of a rate cut in September. If inflation data continues to trend lower, a September cut becomes more plausible.

In summary, while the CPI data didn't provide the anticipated market jolt, it sets the stage for future rate cuts, contingent on upcoming inflation trends.

Watch the live stream where we watched the US CPI live.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.