Trading signals can help one identify trading opportunities, optimize risk management, and enhance overall trading performance. MetaTrader allows traders to subscribe to various signal providers to receive real-time alerts directly on the platform.

This blog will discuss how one can subscribe to these signals on MT.

What are trading signals on MetaTrader?

Trading signals are action triggers that help traders understand market conditions and make better trading decisions. These signals are derived from various analytical methods, such as fundamental/technical analysis and algorithmic models. They assist traders in identifying opportunities, managing risks, and refining their trading strategies.

Stepwise guide to subscribe to trading signals

1. Create MQL5.community account

To begin subscribing to trading signals, the first step is to create a valid MQL5.community account. If a trader does not already have one, they can visit the MQL5 website and follow the registration process.

After creating the account, log in and update the platform settings to ensure account details are integrated under the Community tab. This will enable traders to manage their subscriptions and payments for the signals directly through the platform.

2. Agree to the signal rules

Before subscribing to a trading signal, it is crucial to carefully read and agree to the signal provider's terms and conditions. This step ensures the trader understands the risks, responsibilities, and limitations of subscribing to a particular signal.

The terms will include details about copying strategies, account requirements, and potential restrictions, such as minimum deposit amounts. Traders can only proceed with the subscription after confirming that they accept the rules.

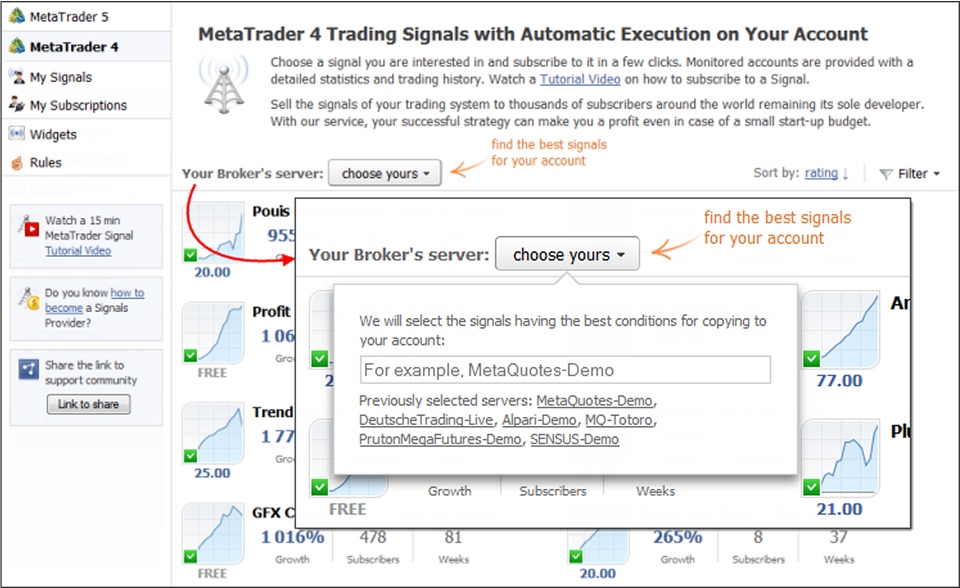

3. Check trading conditions

It is important to verify that one's trading conditions match the signal provider's to avoid any issues during the copying process. The system will check for compatibility, including factors like volume limits for trading symbols and the availability of the same symbols on the account.

If trading conditions mismatch (such as volume differences or unavailable symbols), the trader will receive a warning. Choose signals that match the account's conditions for optimal performance.

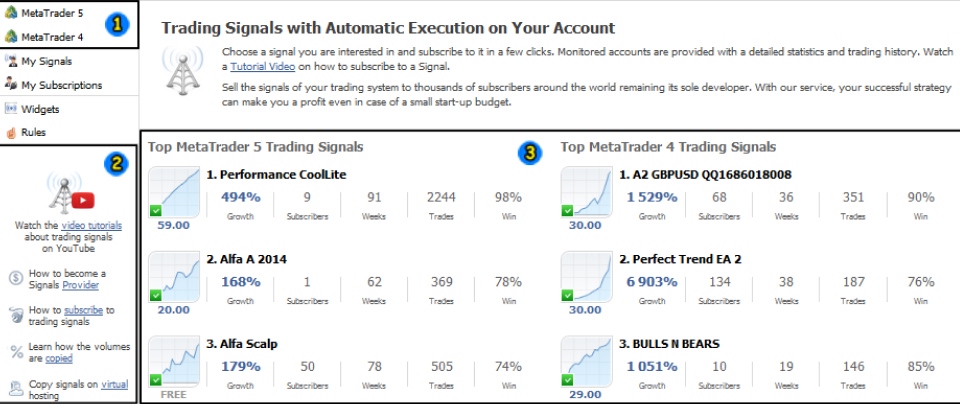

4. Select a signal from the list

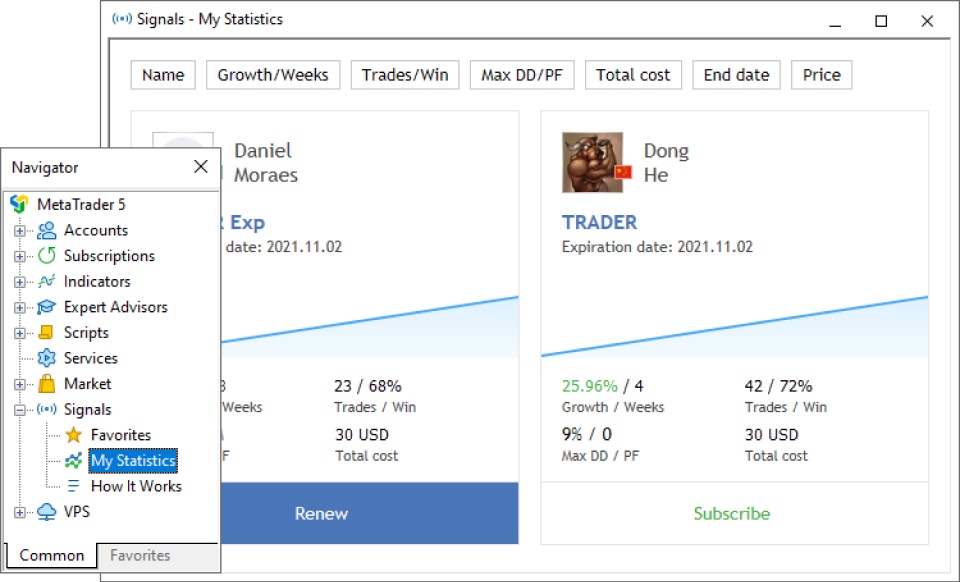

Next, the trader needs to choose a signal that aligns with one's trading preferences and strategy. Select one that suits the trading goals from the list of available signals.

The details of each signal are displayed in a separate window, where one can evaluate factors such as the provider's success rate, account growth, reliability, and the number of active subscribers. Take the time to review this information to ensure it fits the objectives.

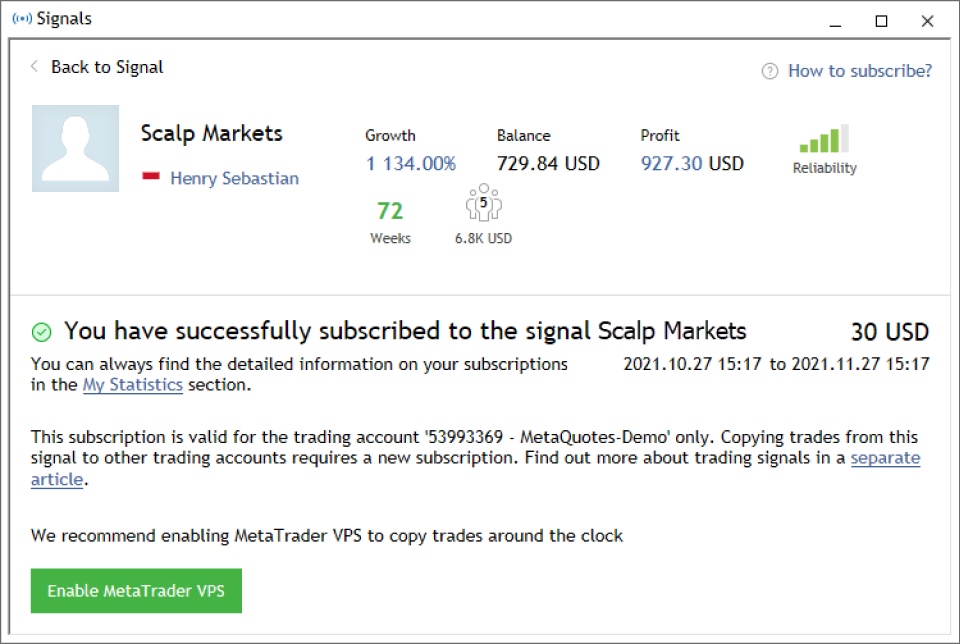

5. Confirm signal details

Once the trader has selected a signal, confirm the details displayed in the signal subscription window. This includes the provider's name, account growth percentage, risk level, and the broker being used.

Make sure these align with one's expectations and trading style. It is also important to confirm the subscription period and any fees involved. Carefully checking these details will help ensure the trader is making an informed decision.

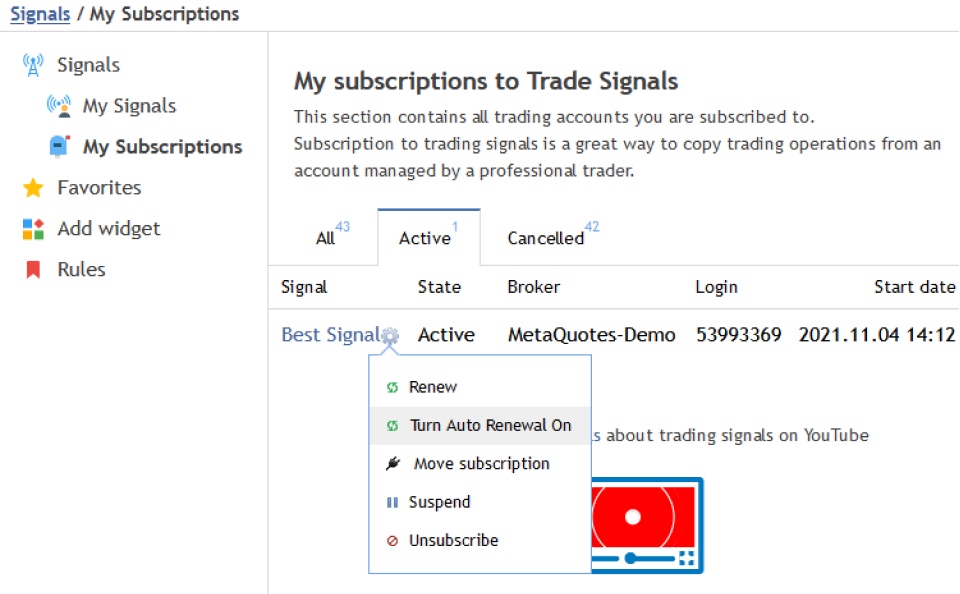

6. Enable auto-renewal (optional)

Traders can opt for auto-renewal to ensure their subscription continues seamlessly after the initial term ends. This option will automatically renew the subscription without requiring manual intervention.

The payment will be processed using the same method used for the first subscription. If the subscription fee changes, they will be notified by email, and auto-renewal will be canceled if the price increases. Enabling this option helps avoid interruptions in signal copying.

7. Make payment for subscription

Once the trader has reviewed and confirmed their signal choice, proceed to payment. Traders can pay using their MQL5 account balance or other available payment systems.

If their MQL5 account balance is insufficient, the system will allow them to use an external payment method. After completing the payment, a confirmation will be shown, and the system will begin synchronizing the account with the signal provider's account.

8. Synchronize accounts

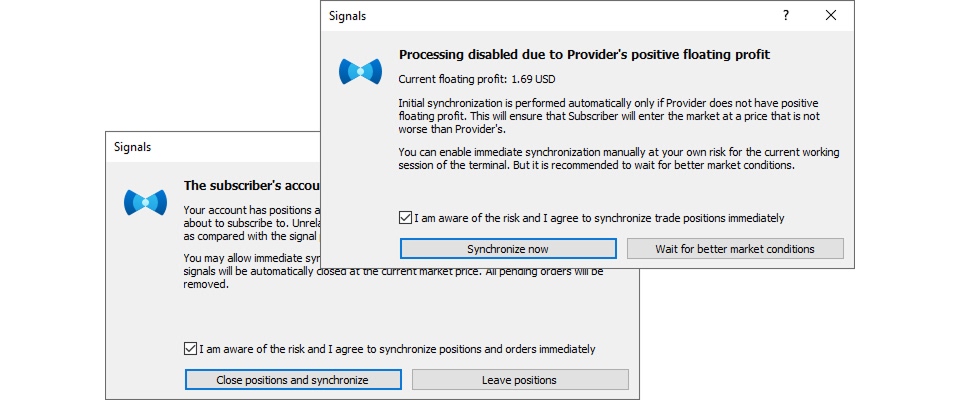

After subscribing and completing the payment, synchronization between the trading and provider accounts is necessary. This ensures that the trades the signal provider executes are copied to the trader's account.

If their account has no open positions or active orders, synchronization can occur immediately. If the synchronization cannot proceed due to existing positions or a positive floating gain, the trader will need to either wait for better conditions or close the positions manually.

9. Configure trading platform settings

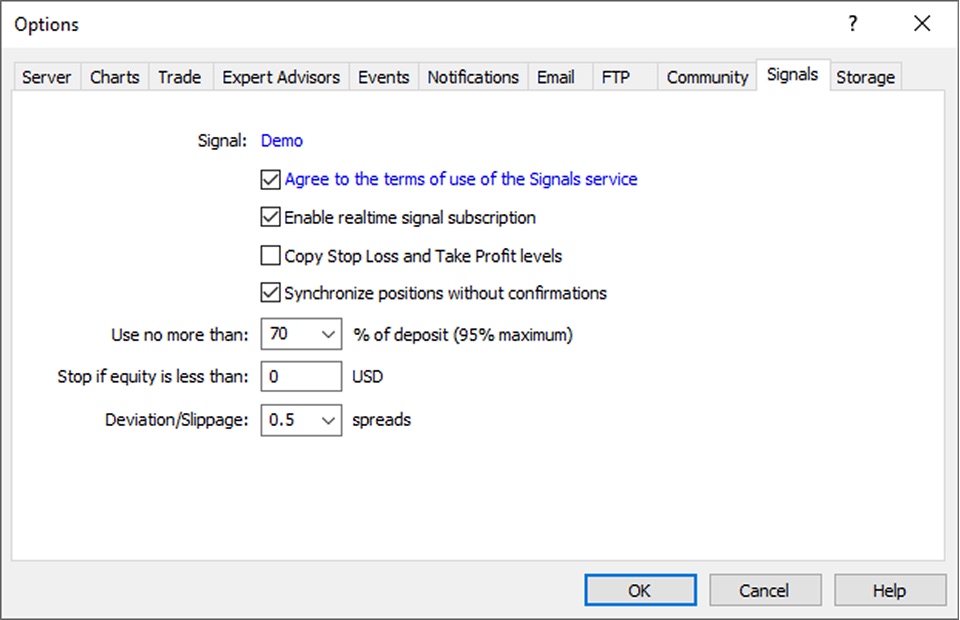

Configure the necessary settings on the trading platform to ensure the signal is copied correctly. Under the platform's Signals tab, enable real-time signal subscription and specify options such as copying stop loss and take-profit levels.

Additionally, traders can set parameters for how much of one's deposit will be used for the signal and define limits to prevent excessive losses. These settings help tailor the signal subscription to the risk tolerance and account management strategy.

10. Monitor signal copying and synchronization

Once the synchronization is complete and the signal starts copying trades to the account, it is important to monitor the performance. Ensure that the trades are being copied accurately and that one's account is aligned with the provider's trades.

Pay attention to deviations or issues, such as differences in execution times or slippage. Regular monitoring allows one to stay informed about the signal's effectiveness.

11. Re-synchronize if necessary

If one notices that trades are missing or discrepancies appear between the trading account and the provider's account, a re-synchronization may be needed. This can occur in cases of network issues, manual interference, or changes in account conditions.

The platform can automatically re-synchronize the accounts to ensure all trades are copied correctly. Re-synchronization ensures that the account stays in sync with the provider's account, preventing missed opportunities or trade mismatches.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Using trading signals to trade forex

Using trading signals judiciously and combining them with one's own analysis is essential. By carefully selecting a reliable signal provider and implementing effective risk management strategies, one can maximize the advantages of MetaTrader signals and improve their overall trading performance.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.