Four central bank interest rate decisions will take the spotlight going into this trading week. Retail traders need to prepare themselves for some volatility around the Australian dollar, Canadian dollar, Swiss Franc and Euro.

Forecast for December 9, 2024

Some of the high priority data points include:

- China Consumer Price Index is forecast to come in higher at 0.5% over the previous 0.3%. Data out of China has not been positive of late and optimism could send Chinese stocks and related currencies higher.

- The RBA is likely to leave interest rates unchanged at 4.35% on Tuesday despite a shock decline in GDP and GDP per capita, which fell for a 9th straight month.

- In Canada the central bank is forecast to cut interest rates by 0.5% to 3.25%. This shouldn’t come as a surprise to traders considering the poor growth in Canada coupled with threats of tariffs by Trump.

- In Europe the ECB is forecast to cut interest rates to 3.15% to try and stimulate the German economy which continues to misfire.

AUD Outlook

The RBA is forecast to leave interest rates unchanged and this is having a negative impact on the economy. In previous comments from the RBA they expected GDP growth of 1.5% in December, which was far from the case. GDP in December was much lower than expected at 0.8%. Higher mortgage rates are leaving Australians without disposable income which could lead to significant consequences.

The AUD/USD price continues to trade lower as market participants look for lower prices. The price now approaches the key 2024 lows of August 5th at 0.6348. If this level fails then price could reach the 2023 lows of 0.6271.

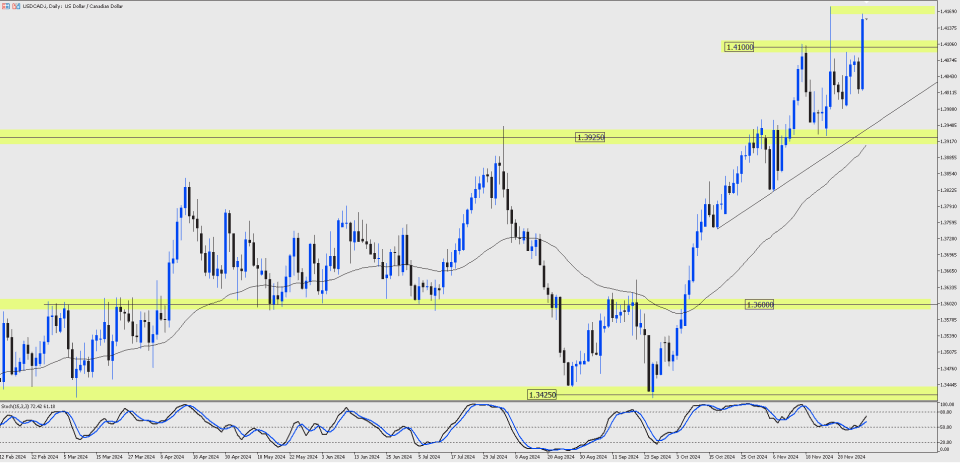

CAD Outlook

The price of USD/CAD raged higher last week as big cuts are expected to come from the Bank of Canada on Wednesday. The central bank will be expected to cut interest rates by 0.5% bringing rates down to 3.25%.

Canada has been in the spotlight recently due to Donald Trump’s announcement to add 25% tariffs on imports. Trump believes this will prevent illegal immigration from Canada into the US. This combined with poor economic data has seen the Canadian dollar weaken.

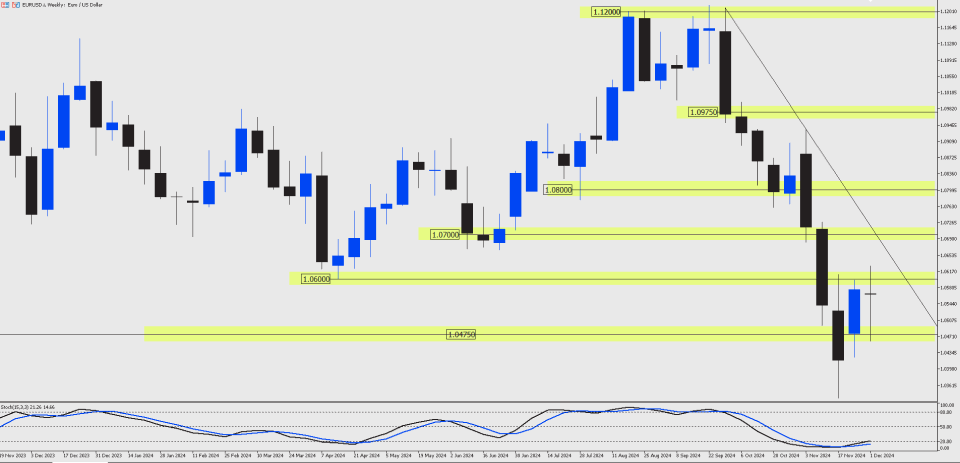

EUR Outlook

The EUR/USD price closed slightly higher than it opened last week holding the key support of 1.0475. The ECB will meet on Thursday with most anticipating a 25 basis points of interest rates to come. The failing German economy has had a huge impact on the Euro with the currency losing value against the USD and the GBP.

Hedge funds however are selling Euro at levels we haven’t seen since 2020. This can often signal a potential reversal for the currency.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.