Get ready for a whirlwind week in forex! Central bank speeches, interest rate decisions, and key economic data await. Stay ahead of the curve with our latest blog! 💼💰 #Forex #Trading #MarketAnalysis

Watch the video to learn more...

Forex Week Ahead Analysis

Hello, fellow traders! As we gear up for another important week in the world of forex, it's time to get ready for some key events that could really shake things up in the market. Let's take a closer look at what's coming up.

Get ready to tune in to some central bank chatter this week! We've got speeches lined up from heavy hitters like the Bank of Japan (BoJ) and the Federal Reserve. These talks could give us valuable clues about where these banks are heading with their monetary policies, and you know what that means – potential market moves!

Curious about interest rates? Well, you're in luck because the Bank of Canada (BoC) and the European Central Bank (ECB) are both set to announce their decisions this week. Forecasts suggest that the BoC will likely keep rates steady at 5.00%, while the ECB is expected to do the same at 4.50%. But hey, surprises happen, so keep those eyes peeled!

Let's not forget about Switzerland! We've got the Consumer Price Index (CPI) month-on-month (m/m) data coming up, and it's expected to show a jump from the previous figure of 0.2% to 0.5%. A higher CPI could shake things up for the Swiss Franc.

Last but definitely not least, we've got the US Non-Farm Payrolls (NFP) report dropping towards the end of the week. Forecasters are predicting a drop from January's impressive 353,000 jobs added down to 190,000 for February. Any surprises here could send shockwaves through the market.

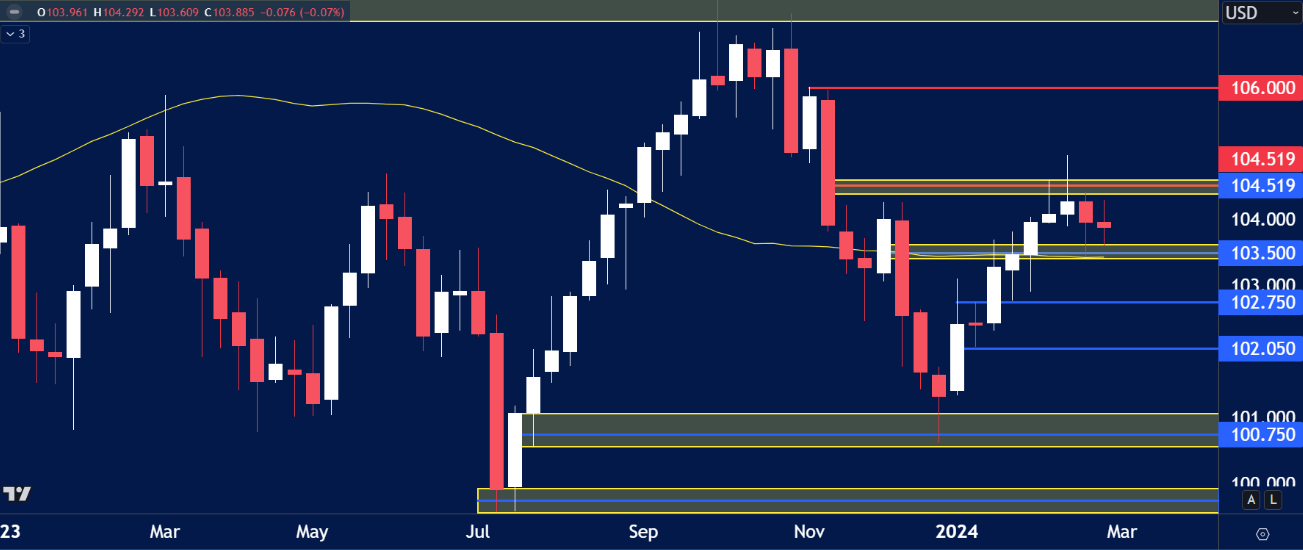

USD INDEX

The price on the chart has traded through multiple technical levels and some observations included:

- USD Index remained range bound last week, consolidating above the support of 103.50, but below resistance of 104.50.

- Several data drops this week could influence price towards either the highs or lows, a break of either could provide some medium term direction.

NZD/USD

The price on the chart has traded through multiple technical levels and some observations included:

- NZD/USD on the weekly time frame formed a bearish close below resistance of 0.6200.

- Sellers are more likely to be active below this level however, a weakening US dollar could prevent strong downside.

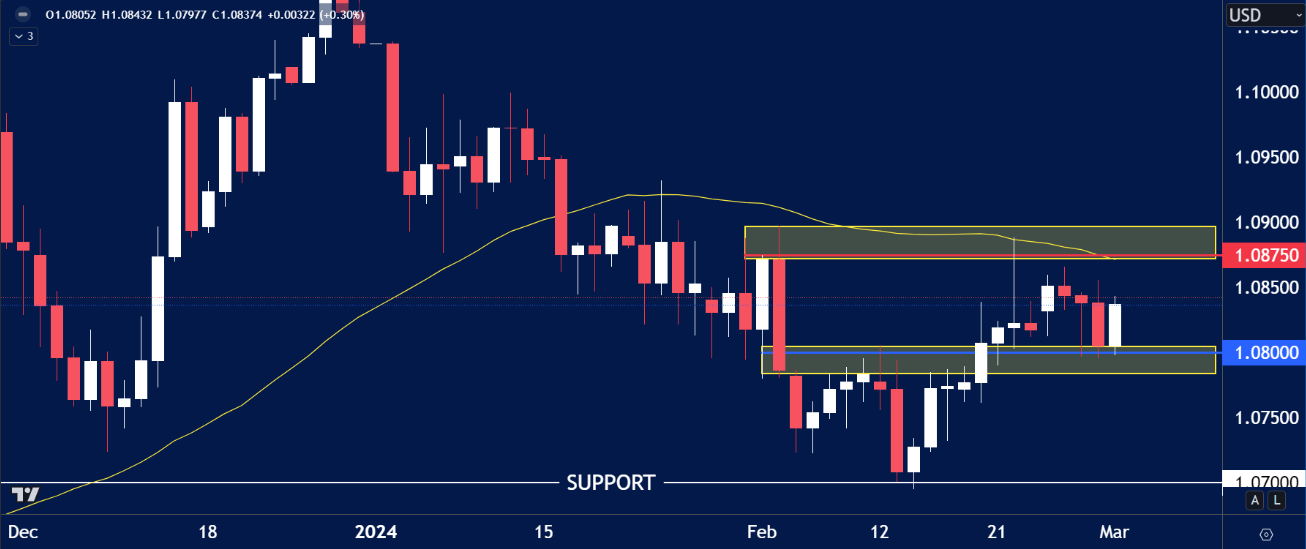

EUR/USD

The price on the chart has traded through multiple technical levels and some observations included:

- EURUSD prices held above the key supporting highs of 1.0800.

- If USD weakens further, buyers may push prices towards the recently rejected highs of 1.0875.

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- GOLD rallied last week into the key resistance of $2085.00.

- US Bond Yields are beginning to fall, causing USD weakness and in turn a bullish Gold price.

- If price breaches the $2085.00 highs we could witness a strong breakout towards $2150.00, the highs of 2023.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.