Retail traders need to remain vigilant this week uncertainty and volatility may remain high as we have three central bank announcements. On top of this we will certainly see further headlines from President Donald Trump.

Forecast for January 27, 2024

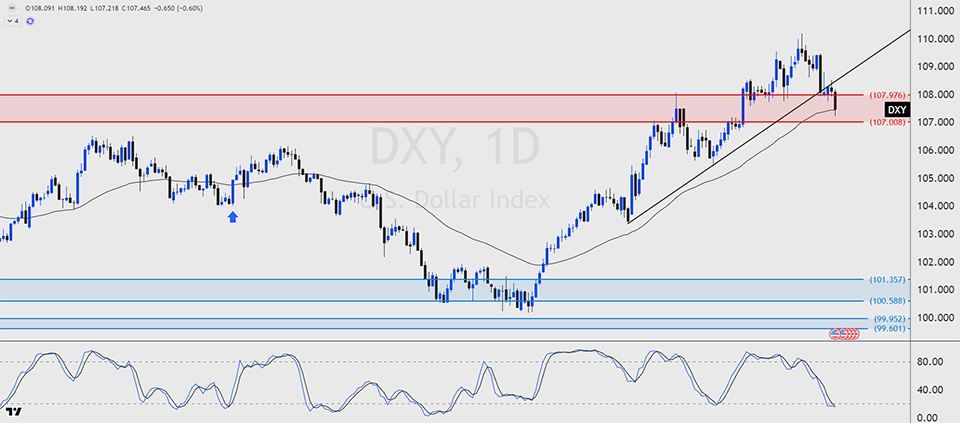

USD Outlook

Investors and traders will hope the market will tell us which type of data it is more sensitive to this week as we will have the first federal funds rate decision since President Donald Trump took office. The old battle of monetary vs fiscal policy is in the spotlight with many seeking some clarity in the uncertainty of Trump. From the Federal Reserves standpoint a rate cut is unlikely. The CME fedwatch tool which tracks the probability of change by using the 30-day Fed Funds futures prices, shows a 99.5% chance of no change in this meeting. This goes against what Donald Trump wants to see, he wants lower interest rates to help create the robust economy of his previous presidency.

The USD Index closed bearish on the week breaking through key demand zones and trend line support levels. This could tell us that the momentum is beginning to shift, a break below the $107.00 support could invite fresh selling pressure.

EUR Outlook

The EURUSD price broke through the trendline resistance which formed from the highs in September 2024. This could signal a shift in sentiment here as the USD weakens in Trump's first week of his presidency. The ECB is forecast to cut interest rates this week by 25 basis points bringing the overnight rate to 2.90% in an effort to re-ignite growth. If the EURO continues to remain positive and the USD remains weak, then EURUSD could trade towards the resistance of 1.0600.

NZD Outlook

The New Zealand dollar was the best performing currency of last week, only losing out to the British Pound. Comments from President Trump of not applying extra tariffs to China boosted optimism for those who trade with the world's second largest economy. Less tariffs on Chinese goods plus stimulus from the Peoples Bank of China could bring growth. New Zealand and Australia rely heavily on China’s economy so a positive outcome here could fuel a rally for NZD and AUD.

NZDUSD did find support at the 2022 lows of 0.5550 and looks to be heading for the swing lows and resistance of 0.5800.

GOLD Outlook

The Gold price rose to the 2024 highs last week as the market continues to price in uncertainty. The Gold price could break through these highs, if they do then the market could push towards $3000.00. The USD weakening could add fuel to the bullish trend. The Commitment of Trader reports highlight a hedge fund's decreasing short positions at aggressive levels essentially remaining long.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.