The Euro could see some early volatility on the open as Germany decides on a new government. Inflation data out of Australia, Japan and the US will be watched closely by traders. We will also see the release of GDP from various countries.

Forecast for February 24, 2025

EURUSD Outlook

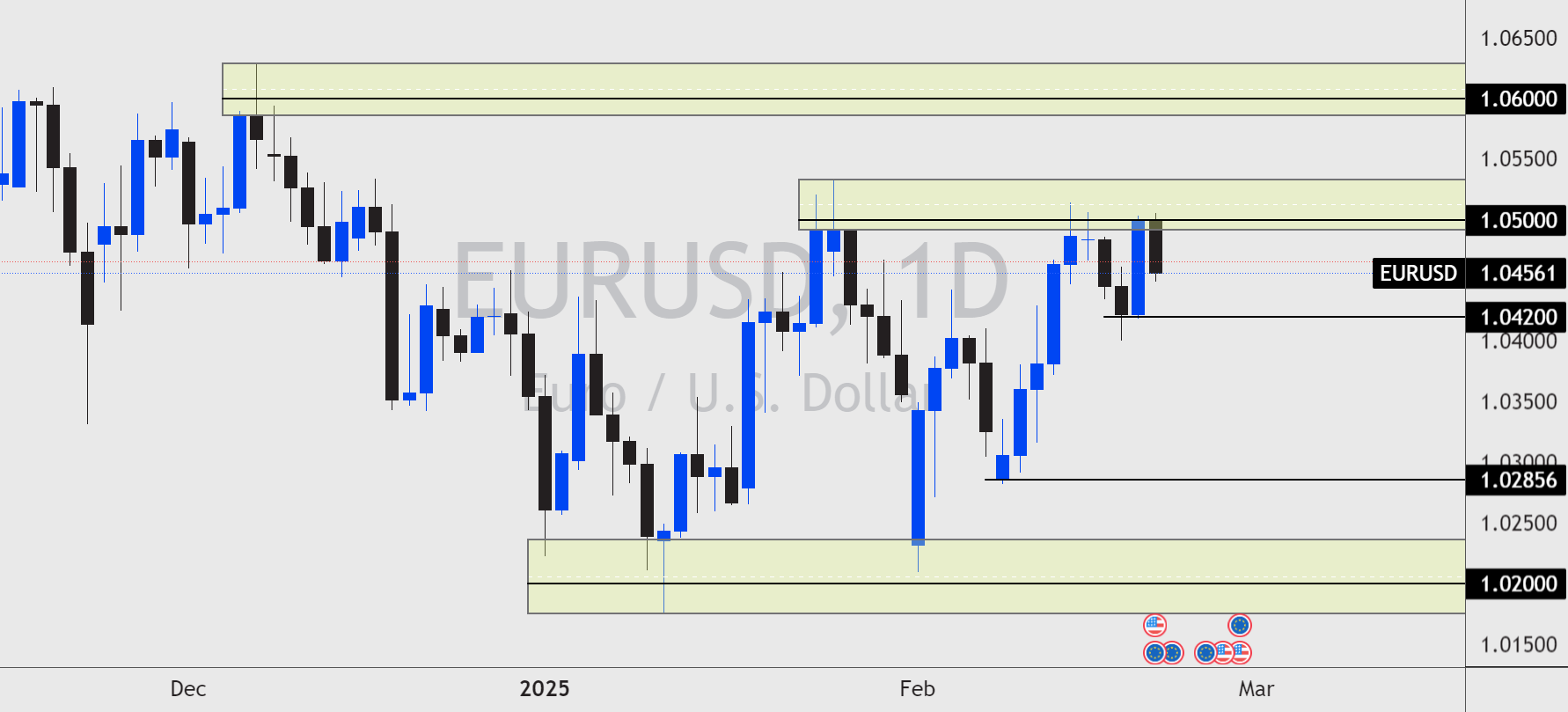

The price of EURUSD largely ranged last week with the price failing to break through the key resistance highs of 1.0500. German elections this weekend could determine what happens to the Euro this week as Germany is the Euro area’s largest economy. Currently as of writing this the Conservative party led by Friedrich Merz is leading in the polls, however, no government will be able to lead without a coalition, which could take weeks to unfold. The far-right AfD has gained significant support and is potentially going to gain significant seats. The party led by Alice Weidel has been backed by Elon Musk and US Vice-President JD Vance.

Despite this, political stability could bring some support for the Euro which has struggled to gain much ground against the USD in recent months. The commitment of trader reports show hedge funds adding 13,005 contacts long showing that large speculators are perhaps re-adjusting positions.

If the price traded through the key resistance of 1.0500 then we may see prices head for the 1.0600 resistance formed from the December highs. A hold below this resistance could see the price trade back to the recent swing lows of 1.0400.

USDJPY Outlook

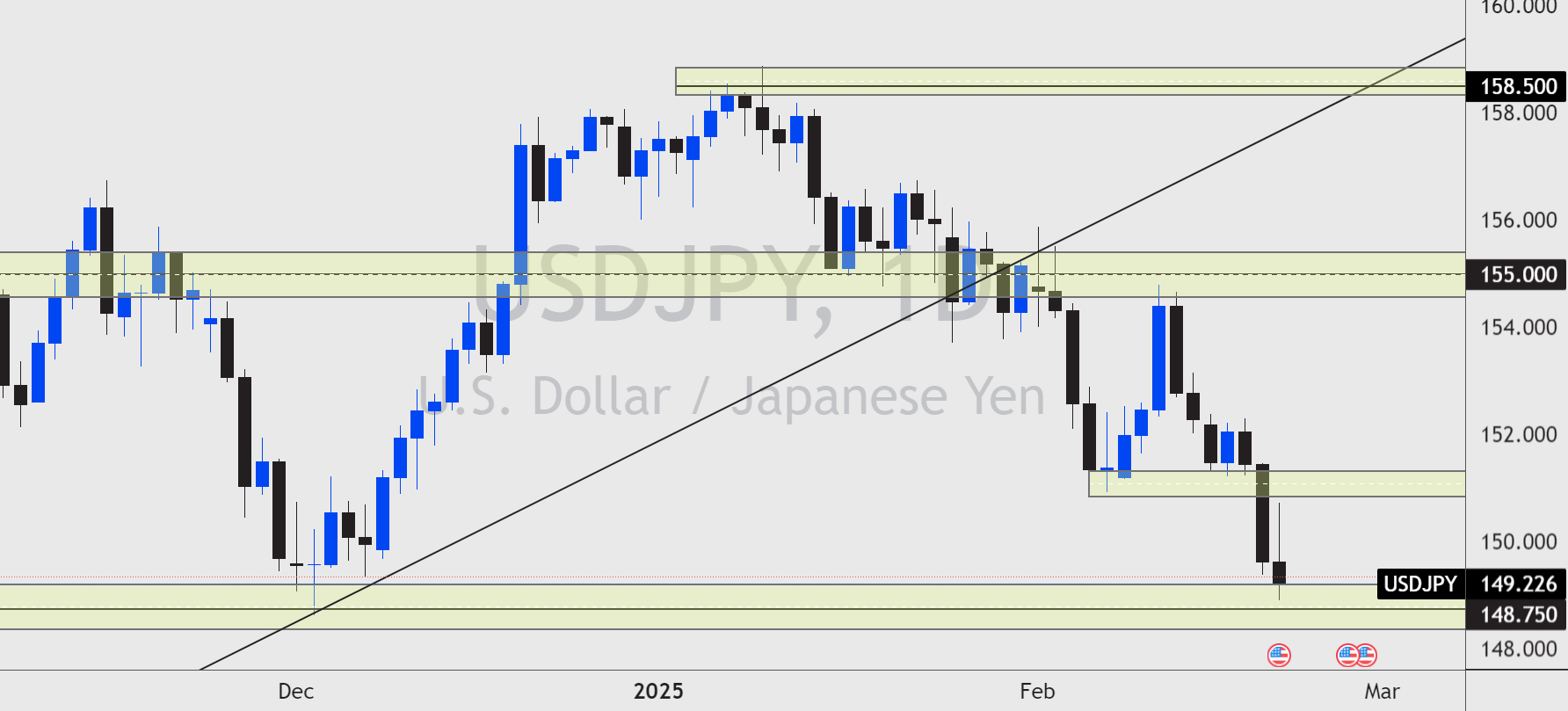

The Japanese Yen was the best performing currency of last week and it came as no surprise. Geo-political tensions between the US and Europe over the situation with the Russia vs Ukraine war continued after the US held a meeting with Russia. This combined with favourable Japanese economic conditions saw the JPY strengthen against all G7 currencies.

USDJPY traded through the daily swing lows and has now come into contact with the weekly support lows around 149.00. If the price breaks through this level then the price is in danger of heading for the September lows of 140.50.

US Stock Markets Outlook

The Dow Jones closed lower by -2.56% last week after concerning services PMI data was released. This came after Walmart predicted sales to fall over the next year, telling us that the consumer could be losing confidence in the economy. US CB Confidence released on Tuesday will be watched closely as this is a leading indicator of consumer spending. If the consumer continues to feel worried about future inflation then companies profits and demand could fall.

The weekly chart shows a key low and support around $42,000. This level will be pivotal to the sentiment of this market. A hold above this level could influence buying opportunities for traders. A break below could signal further negative sentiment.

Silver Outlook

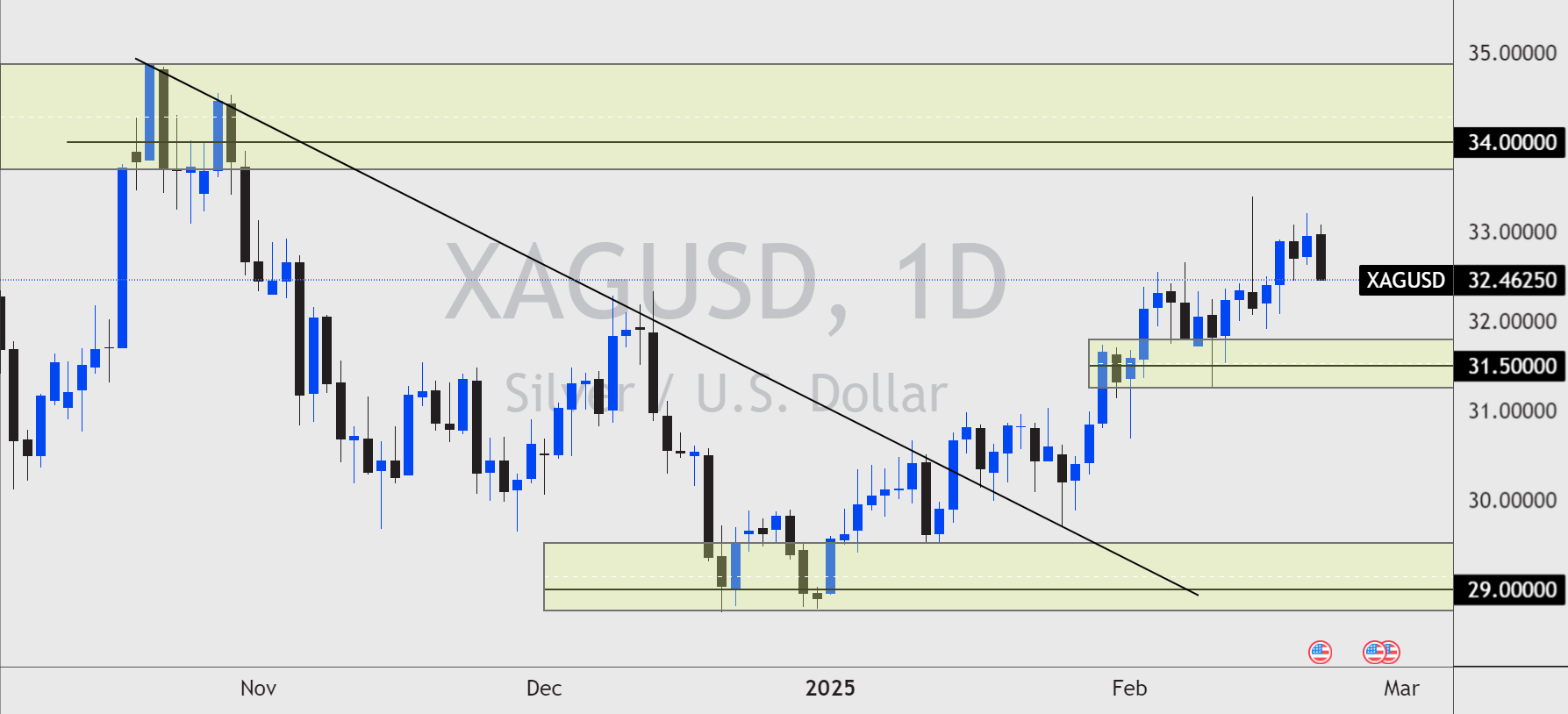

The price of Silver closed bullish for a fifth consecutive week, the longest streak since September of last year. The Gold/Silver chart shows us that the price of Gold is overbought against the price of Silver. This tells us that investors and traders may favour silver prices more in the short term.

A stock market lower could prompt some selling on Silver and Gold as funds and investors look to cash in on the gains made on the precious metals. This could see the price of SIlver trade towards the daily swing lows around $31.50.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.