For retail traders this week will be a pivotal one. Every four years in the US we get the luxury of volatility provided by the inauguration of a new president. With that comes the pull of fiscal policies which can come as a surprise to new traders. Those more experienced in the markets may recall the first time President Trump took over the White House in 2016.

Forecast for January 13th, 2024

USD Outlook

This being the second term for Trump brings into question how aggressive he will be concerning tariffs. Could this be his last chance at making the changes that could impact Americans in the foreseeable future. Though the ‘Trump Trade’ took over the last quarter of the year the market is in a very different place. The US economy has performed ‘well’ under higher inflation and higher interest rates. The unemployment rate has been retreating, coming in at 4.1% in December. This saw stock markets break its bearish December patch and turn bullish.

The USD remains strong and with the US 10-year yields heading towards 5%, this strength is showing no signs of slowing. The EUR, CAD and GBP seems to be the worse off and any sudden bursts of USD strength this week could sink these forex pairs lower.

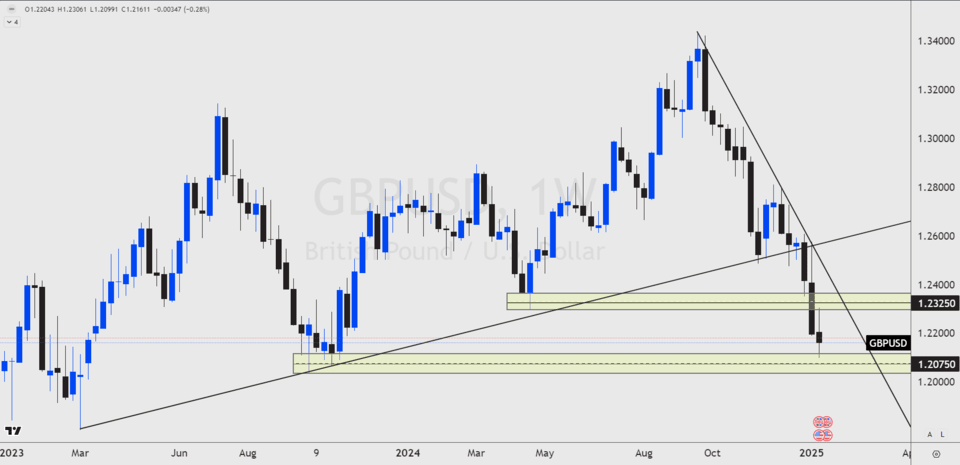

GBP Outlook

In the United Kingdom the focus shifts back to labour market data with the claimant count change forecast to climb to 10.3k which could compound the GBP weakness. Fiscal worries and slow growth has caused the market to sell off the GBP and with the USD being so dominant, GBPUSD prices could continue to fall. The major forex pair known as ‘cable’ is trading at the support of 1.2075. A break below this level could invite further selling by the market.

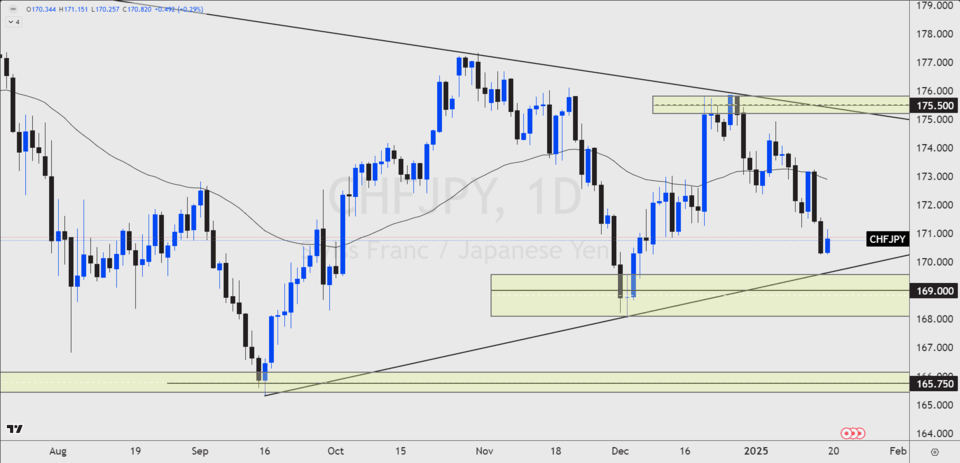

JPY Outlook

The Bank of Japan could raise interest rates this week to 0.5% from 0.25%. This will bring their policy rates to their highest level since 2008. A stronger economy and higher inflation pressures have encouraged the central bank to hike interest rates. But the timing could put doubts on a cut.

Japan’s central bank governor Ueda made comments last week suggesting the central bank will hike interest rates but remained vague on the timing. President Trump’s inauguration this week could be the catalyst to hikes in Japan, but they could disappoint and hold off until another meeting.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.