Dive into the recent USDJPY plunge! 📉 With over 400 pips lost last week and key support at 146.50 tested, what's next for this volatile pair? Stay informed, stay ahead. #ForexAnalysis #USDJPY #MarketWatch

Watch the video to learn more...

- USDJPY plunged over 400 pips last week due to weak US economic data.

- Poor Non-Farm Payroll (NFP) numbers contributed to the decline.

- Market uncertainty looms over whether USDJPY will continue its downward trajectory.

Exploring the Recent Plunge of USDJPY: Is Further Decline Imminent?

USDJPY, a currency pair often influenced by the economic performance of the United States and Japan, witnessed a significant downturn last week. Plummeting over 400 pips, this sharp decline followed a string of disappointing US economic data, prompting concerns about the strength of the US dollar.

One of the key factors contributing to this downward spiral was the release of poor Non-Farm Payroll (NFP) numbers. These figures, indicating weaker-than-expected job growth, sent shockwaves through the forex market, causing USDJPY to approach a critical support level at 146.50.

The breach of this support level raises questions about the future direction of USDJPY. Will the pair continue its descent, or is a reversal on the horizon? To answer this, it's crucial to assess the broader economic landscape and the factors driving market sentiment.

Upcoming data this week could be make or break for the greenback. Consumer Price Index (CPI) m/m is forecast to come in above the previous reading at 0.4% over 0.3%. However, a softer inflation rate will suggest that the Fed could cut rates sooner rather than later.

This round of data is pivotal in the race of lowering interest rates, positive data would boost the USD and go against the narrative from the Federal Reserve.

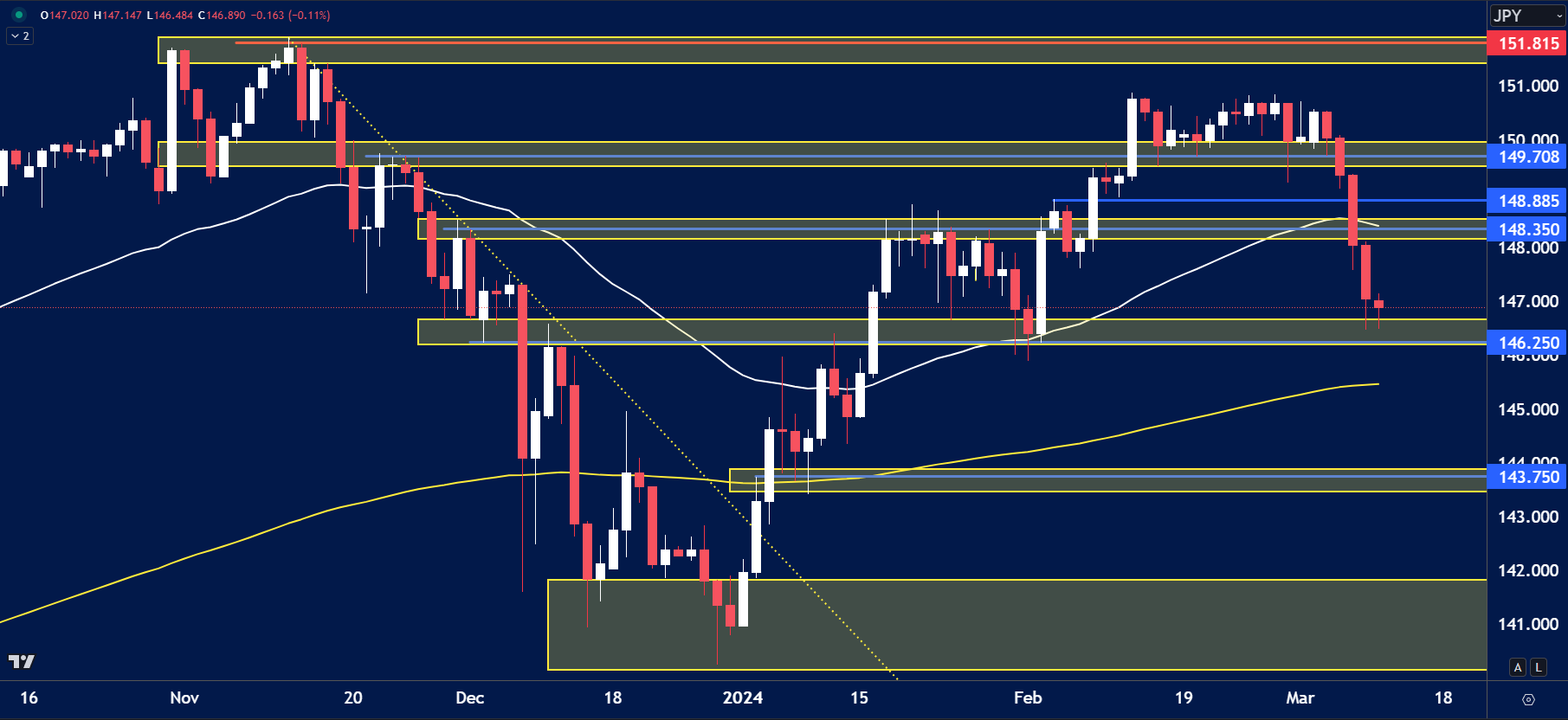

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- Price fell over 400 pips showing the strength of the JPY and weakness of the USD.

- Price found support towards the key level of 146.50.

- Sellers may wait for prices to trade higher before looking for short opportunities.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.